Overview Article - Decarbonisation of buildings' heating system with heat pump technologies: an overview of EU policies and projects

Overview Article - Decarbonisation of buildings' heating system with heat pump technologies: an overview of EU policies and projects

(Note: opinions in the articles are of the authors only and do not necessarily reflect the opinion of the EU).

Introduction

Heat pumps are devices that transfer heat from one location to another using a refrigeration cycle or a thermodynamic process. They can be used for heating, hot water, and space cooling purposes in buildings and are a mature technology which is much more efficient than boilers. There are different types of heat pumps:

- Air source heat pumps: They use the energy from outside air or air from ventilation systems for heating, cooling, and heating water.

- Water source heat pumps: They use the energy stored in ground water, surface, or sea or sewage water. Heat is absorbed from water, and is made available for heating, cooling, and preparation of hot water.

- Ground source heat pumps: They use the energy stored in the ground, from which they extract heat.

- Hybrid heat pumps: This refers to an appliance or a system of appliances which combines at least two different energy sources and whose operation is managed by one control. The hybrid heat pump combines an electric heat pump with a condensing boiler. The reliance on two technologies makes them very efficient in different seasons.

What about heat recovery systems for buildings? The primary distinction between a heat pump and heat recovery cycle is that a heat pump cycle produces only one effect (e.g. heating or cooling) at a time whereas a heat recovery cycle produces both effects simultaneously.

A recent study by the University of Oxford and the Regulatory Assistance Project has demonstrated that heat pumps are also efficient in extremely cold climates, revealing they were twice as efficient as electric heating systems. Moreover, it has been highlighted that air-source heat pumps are suitable for freezing temperatures. Heat pumps are widely used in the coldest parts of Europe, providing 60% of the total heating needs in Norway, and more than 40% in Finland and Sweden. Those three Scandinavian countries have also the highest number of heat pumps per capita in the world.

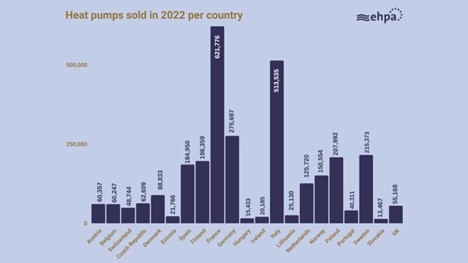

According to Eurostat, around 50% of all the energy consumed in the EU is used for heating and cooling, and more than 70% still comes from fossil fuels. Concerning residential buildings, around 80% of the final energy consumption is used for space and water heating. According to EHPA´s 2023 market report, Europe has experienced a record growth in heat pump sales in 2022. Among the EU Member States, France is the lead in heat pump sales, followed by Italy, Germany, Poland, and Sweden. Only ten countries represent 87% of the European market volume. The picture below clearly depicts the heat pumps sold in 2022 per country.

Figure 1.0. Heat pumps sold in 2022, by country. Source: EHPA, 2023 Market report (access here).

Although there are very positive numbers coming from some EU countries, if things stay this way, it would not be possible to reach the decarbonisation targets for heating by 2050.

A report by the International Energy Agency (IEA) predicts that heat pumps have the potential to globally reduce CO2 emissions by at least 500 million tonnes by 2030. Another key point and challenge to be overcome to increase the uptake of heat pumps in buildings is that there is a need to establish specific policies to support consumers of heat pumps in the initial high costs. Nonetheless, the heat pump sector is affected by changes of national governments and thus changing of national policies and the subsidies available, and by gas prices which have been recently fallen whereas electricity prices have remained high. This has led to a drop in sales of heat pumps in many countries during 2023 (e.g. Italy, Finland, Poland) compared to 2022.

It is also important to mention the skills shortage of installers which is slowing down the uptake of this technology across the EU. In fact, as stated by Jozefien Vanbecelaere and stressed by all the other panellists involved during the panel discussion of the BUILD UP Ambassador meeting 2023, “There is a huge skills shortage. We lack skills at local and national level, (…) it’s about reskilling, upskilling, or creating new skills for the people”. Hence, the importance of focusing on the national level and how the EU policies will be translated has been emphasised. The issue of skills shortage for heat pumps has been specifically addressed by EU policies (e.g. recast Energy Performance of Buildings Directive and Renewable Energy Directive) as well as by EU projects (e.g. HP4All).

Policy context about heat pump technologies

There are several EU policies and initiatives aimed at promoting energy efficiency, reducing greenhouse gas emissions, and advancing the use of renewable energy sources. In doing so, they also target the implementation of heat pumps for the decarbonisation of heating in buildings. The list below will explain the link between those policies and heat pumps.

- Renovation Wave: This initiative identifies three main areas of intervention to double the energy renovation rate of buildings in the European Union: tackling energy poverty, renovating public buildings, and decarbonising heating.

- REPowerEU: The plan was launched in 2022 to help the EU to reduce energy dependence from Russian fossil fuels by saving energy, producing clean energy, and diversifying energy supplies. Among other things, the plan sets the goal of doubling the current deployment rate of heat pumps in buildings, with the objective of installing at least 10 million additional hydronic heat pumps by 2027.

- Energy Performance of Building´s Directive (EPBD): The revised EPBD, which is about to be officially published, specifically refers to the renovation of buildings, their systems and improving the systems´ integration of heating. As heating and domestic hot water accounts for 80% of household energy use in the EU, it becomes pivotal to decarbonise them and make them more energy efficient. Heat pumps are expected to become a widespread solution to new buildings and existing buildings in combination with smart technologies. In particular, the Commission aims to phase out fossil-fuel heating by 2040. The text also includes other key elements: (i) Minimum Energy Performance Standards (MEPS) for existing buildings (with non-residential buildings to reach D class by 2030 and residential buildings to reach D class by 2033), (ii) instruments to mobilise finance for deep renovation with grants and subsidies available to vulnerable households, and (iii) the requirements of Member States to put in place One-Stop-Shops (OSS) as free-of-charge information points.

- Renewable Energy Directive (RED): The revised Directive EU/2023/2413 has just entered into force on 20th November 2023, and it sets an overall renewable energy target of at least 42.5% binding at EU level by 2030. The replaced paragraphs 3 and 4 of article 18 state that there are some requirements from Member States in relation to training and skills for renewable heating. In particular, they should ensure that certification schemes are available for installers and designers of all forms of renewable heating systems in buildings. They also will need to make sure that trained and qualified installers are available for the installation of renewable heating considering the growing demand, and finally they should also ensure qualification and training schemes to keep up with the level of innovations.

- Energy Efficiency Directive: The recast Energy Efficiency Directive (EU) 2023/1791 introduces a series of measures to help accelerate energy efficiency and the principle of energy efficiency first. In particular, the directive promotes local heating plans in municipalities above 45,000 inhabitants with the setting up of One-Stop-Shops and build capacity among local authorities.

- Green Deal Industrial Plan: This aims at enhancing the competitiveness of Europe´s net-zero industry and supporting the transition to climate neutrality. In doing so, it also aims to scale up the EU´s manufacturing capacity for net-zero technologies. It expresses the ambition to deploy 30 million or more additional heat pumps by 2030 as compared to 2020. For this deployment, 750,000 more installers are needed and at least 50% of existing ones need to be reskilled. The Plan complements the EU Green Deal and REPowerEU initiative.

- F-gas regulation: The consumption of hydrofluorocarbons (HFCs) will be completely phased out by 2050 and their production will be phase-down to a minimum by 2036. This regulation introduces a full ban on small (<12kW) monobloc heat pumps and air conditioning that contain F-gases with a GWP of at least 150 starting in 2027, and a complete phase-out in 2032.

- Ecodesign and energy labelling regulation: The aim of this is to increase the energy efficiency of products and reduce their overall environmental impact. The Ecodesign regulation sets specific requirements to be met by manufacturers of heat pumps, fostering continuous innovation. The energy labelling regulation is a tool to help EU consumers when choosing energy efficient products, and thus complements the Ecodesign requirements with mandatory energy labelling requirements.

Funding instruments

In addition to regulatory measures, there are financial incentives, or subsidies that can be provided at both EU and national levels to promote the adoption of heat pumps in buildings. Among these EU financial instruments, we find:

- Social Climate Fund: All EU countries will be able to benefit from this fund with the aim of supporting energy efficiency measures and the decarbonisation of heating and cooling in buildings, including the installation of heat pumps both for vulnerable households and micro-enterprises.

- Recovery and Resilience Facility: It is at the heart of the REPowerEU implementation, and energy efficiency and building renovation are key components of the funding.

- Horizon Europe Energy programme: The Cluster 5 – Energy Climate and mobility, calls for developing and demonstrating novel and disruptive renewable energy technologies with specific calls addressed to the buildings sector.

- LIFE Clean Energy Transition sub-programme: It supports the delivery of EU policies in the field of sustainable energy and decarbonisation. Among the recently closed call, for proposals titled Boosting heat pump deployment through alternative models and skilled installers can be highlighted.

EU-funded projects

Following is a selection of EU-funded projects coming from different EU programmes.

LIFE programme

- GeoBoost: The project will support the implementation of the Renewable Energy Directive by allowing a market uptake of geothermal heating and cooling technologies. In doing so, the project will seek to unlock market barriers for geothermal heat pumps which represent the most energy efficient and cost-effective heat pump solution.

- CLEAR-HP: This aims to facilitate consumers´ access to heat pumps by supporting consumers throughout the whole purchase journey, and by addressing financial and regulatory barriers. This will empower consumers to lead the clean energy transition and eventually to reduce their energy bills.

- Street-HP Reno: The project aims to deploy collective purchasing approaches for energy system replacement by heat pumps for individual homes at the scale of entire streets. To do so, relevant stakeholders will be involved, such as local authorities, housing organisations and residents.

- COHEAT2: The project aims to help municipalities in the region of Southern Denmark to cope with their obligation to ensure the green transition of the heating of buildings and households. The focus is on individual heat pumps and local heating where multiple buildings unite in a micro grid and district heating combined with energy renovation of buildings. A local energy planning process would ensure that the appropriate solutions are tailored to the local context and linked to existing SECAP/SEAPs.

Horizon 2020 programme

- HAPPENING: The aim of the project is to develop a solution based on decentralised heat pumps that are easy to install, low-intrusive for the occupants, and adaptable to different building needs. The challenge of cost-competitiveness is addressed by developing new financial and business models.

- Superhomes2030: The aim of Superhomes2030 is to drastically scale the Superhomes model in Ireland - a deep retrofit concept for single-family buildings developed by Tipperary Energy Agency - to move from a model, which completes 100 retrofits worth EUR 6 million per year in 2019 to 500 retrofits worth EUR 36 million per year by 2023, and 3,000 worth EUR 150 million by 2030, which is 10% of the National Target. Some of the project outcomes include: (i) development of a One-Stop Shop, engaging high performance contractors to deliver quality retrofits, (ii) training for SMEs, contractors and homeowners, (iii) open-source energy performance data platform (Superhomes Digital Hubs).

- REPLACE: The project motivated and supported people in eight different countries (Austria, Bosnia and Herzegovina, Bulgaria, Croatia, Germany, North Macedonia, Slovenia, and Spain) to replace their old heating systems with greener alternatives based on informed decisions. The project provided online tools (e.g. an easy-to-read matrix showing which heating systems are well suited for which building type, and a more elaborated calculator for intermediaries to replace heating systems) that are used together with regional campaigns such as the establishment of information points, support for community and collective actions or site visits (e.g. support for the collective purchase of heat pumps in Slovenia).

- HP4All: The main objective of the project was to enhance, develop and promote the skills required for high quality, optimised Heat Pump (HP) installations within residential and non-residential buildings. Both the supply side (manufacturers, SMEs, installers etc.) and demand side (building owners, public sector etc.) have been engaged in the project. A core element was the application of tailored measures in three pilot regions: Ireland, Upper Austria, and Andalusia/Spain, aiming to address different HP market sectors, applications, and technology solutions. Each pilot region took specific approaches to the roll out of targeted activities and materials, and the development and promotion of HP Skills depending on different context and market maturity. The main activities carried out are summarised in this video.

- For other projects or more specific description of the project abovementioned under this programme, please consult the latest Cordis Results Pack.

Horizon Europe programme

- BHE: Blue Heart Energy (BHE) has developed a disruptive patented technology based on thermo-acoustics that significantly improves the performance of heat pumps. In this way heat pumps turn into silent devices and do not use any HFC-gases. The project is designed as a B2B model to leverage the distribution channels of heat pump manufacturers and eventually a fast adoption by end customers.

IEA Annex

- Annex 60 Retrofitting heat pump systems in large non-domestic buildings: The aim is to identify and quantify the technical complexities of non-domestic buildings (they vary in form, size, function and energy use leading to a variety of heat pump system options), and provide advice and tools to decision-makers during the retrofitting process.

How to implement heat pumps in buildings: organisations

There are some EU organisations whose focus is renewable heating, heating technologies, and heat pump implementation in buildings. These are:

- EHPA (European Heat Pump Association): It is the voice of the heat pump sector in Europe. They aim for the complete decarbonisation of heating and cooling solutions. They work to shape EU policies and speed up the market development of heat pumps.

- European Heating Industry (EHI): This brings together companies that are leaders in the production of efficient heating systems, such as boilers, solar thermal systems, heat pumps, fuel cells, radiators, and underfloor heating.

- REHVA (Federation of European Heating, Ventilation and Air Conditioning association): This is an umbrella organisation representing over 120,000 HVAC designers, building service engineers, technicians, and experts across 26 European countries. Their mission is to develop and disseminate economical, energy efficient, safe, and healthy technology for mechanical services of buildings, to facilitate knowledge exchange of the topics of heating, ventilation, and air conditioning, and to support the development of EU policies at the national level.

- EGEC (European Geothermal Energy Council): it is a non-profit international organisation founded in 1998 to promote the European geothermal industry and enable its development both in Europe and worldwide, by shaping policy, improving business condition, and driving more research and development.

Conclusion

In conclusion, the widespread adoption of heat pump technology in Europe marks a pivotal step towards achieving sustainable and energy-efficient solutions for heating needs in buildings. With the imperative of reducing carbon emissions and fighting climate change, heat pumps emerge as a versatile and eco-friendly alternative. They offer not only energy savings for consumers but also contribute significantly to the overarching goal of achieving carbon neutrality. However, challenges persist, including upfront costs, infrastructure development, public awareness, and a shortage of installers and professionals in general. Addressing these hurdles with the appropriate policies and financial instruments will be essential to ensuring the necessary continued growth.

-